Here’s what got me thinking this week – the concept of asymmetric risk reward and how it might be applied to property.

I was watching an interview with Tony Robbins discussing financial success principles where he was highlighting some common findings having interviewed 50 of the smartest and most successful financial people in the world.

He said, ‘they are all obsessed with this idea of having the least amount of risk with the most amount of return’. That right there caught my attention, that’s what we all want in property too right?

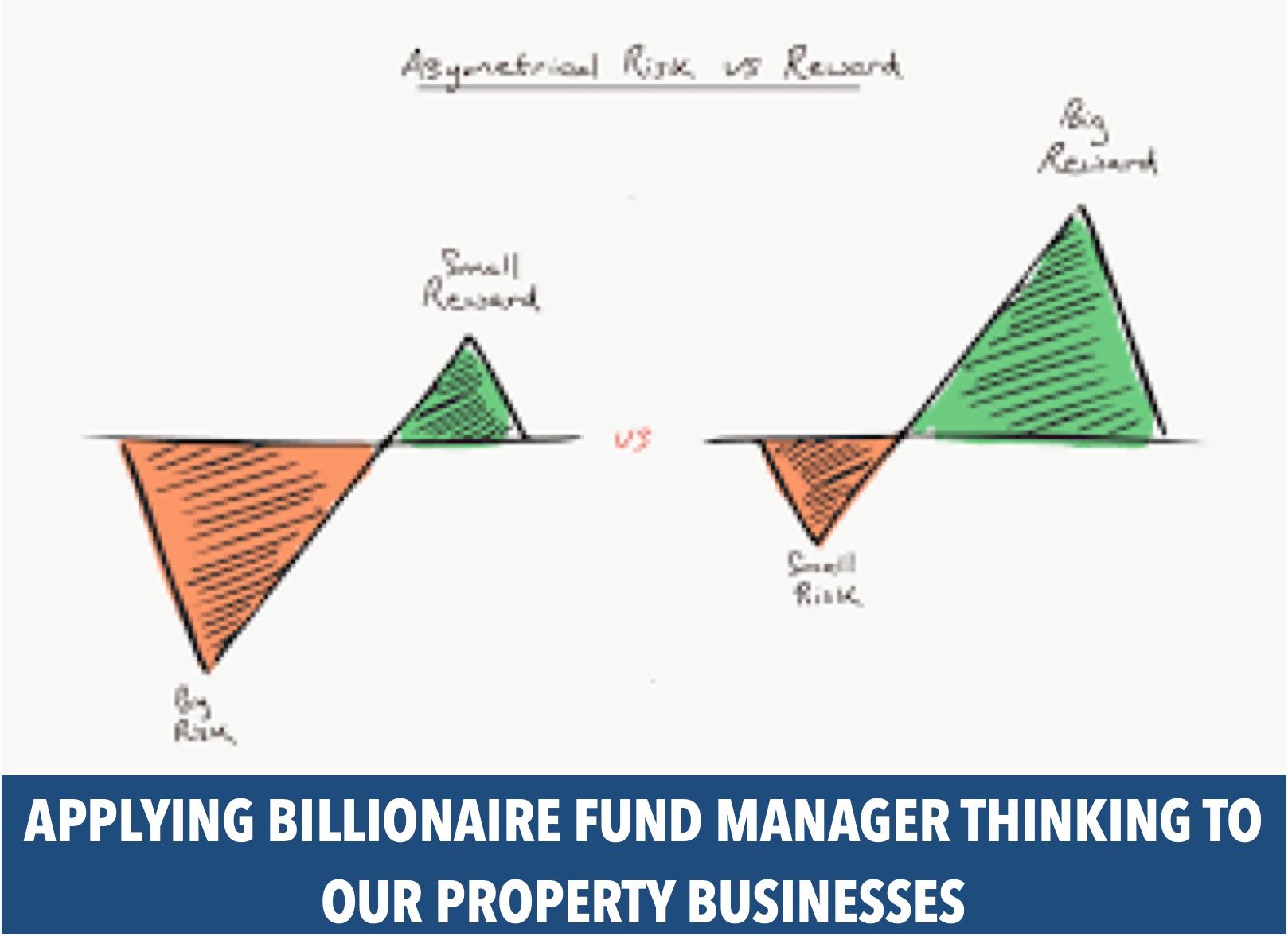

They call it ASYMMETRIC RISK REWARD – Here’s a google definition of it ‘An asymmetric payoff (also called an asymmetric return) is the set of possible results of an investment strategy where the upside potential is greater than the downside risk.’

Tony referenced billionaire hedge fund manager Paul Tudor Jones who doesn’t just look for a ‘nice return’, he looks for a risk return ratio of 5:1, in other words if he risks $1 he can make $5. He knows he’s going to be wrong sometimes but he understands that he can risk not making money up to four out of five dollars and still make money overall.

That thinking and that approach puts you in a very different position to most people.

Another example of asymmetric returns that Tony referenced was the way Richard Branson set up Virgin Atlantic. In those early days he invested a year in negotiating the first 5 Boeing jets so there was no downside. Here’s how- if in the first 3 years he didn’t succeed with his airline, he negotiated a deal to give back the planes with no loss to him. So it was all upside potential and minimal downside.

We may not always be able to find a 5:1 ratio but the main thing is to force ourselves to think differently from the ‘average’ investor.

This quarter Chris and I are working on our strategy for growing our build to rent (BTR) portfolio. We see this as a great way to create the long term rental asset base that we would like to hold.

A conversation with a developer friend at the start of the week reminded me that with BTR, even if your aim is to build a profitable asset base to hold long term, the best outcome may actually be to sell up to 4 out of every 5 developments. Interestingly, this friend comes from a hedge fund background so on reflection I can see how the thinking ties in with this concept of asymmetric risk reward. In other words not, all the BTR opportunities we identify will meet our criteria for holding, but when it meets the criteria for other long term investors then it makes sense to build-to-rent-to sell. So rather than narrowly focusing on the one exit of us holding and passing up on lots of potential deals, if we open our mind to this way of thinking we can increase the upside and minimise the downside.

The key message/reminder for us all in property is to look for ways to engineer asymmetric rewards by maximising the upside and protecting the downside. The simplest way to protect the downside of course is to have multiple exits. Even better is to line up your primary exit with commitment in advance (ie a pre-let agreement, a booking agreement etc) AND give yourselves multiple alternative exits. By doing that we really can create asymmetric risk reward ratios in property.

What are you already doing, or can you do, in your property business to create asymmetric returns?