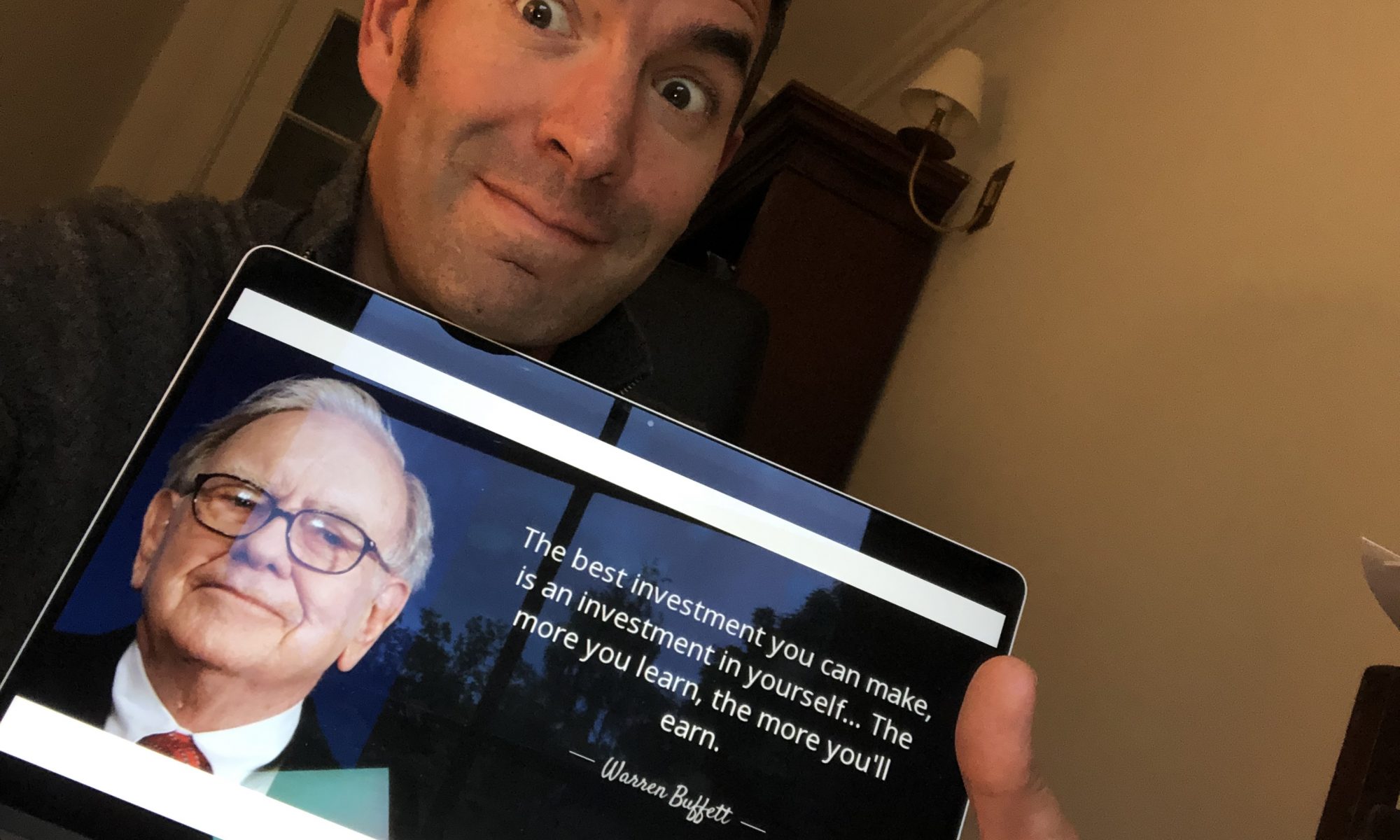

Almost everyone in the property community will at some point have heard this quote from Warren Buffet, but we often need reminding of it.

One reminder for me came recently from a brilliant entrepreneur in property who was talking about the economic backdrop and how we can choose to respond- essentially stating that the best investment you can make during times of inflation and recession is in yourself.

You can interpret that in many different ways but in the context of property it’s well worth the time reflecting on this – how can you invest in yourself during these times of inflation and pending recession?

Investing in yourself can take many forms, from taking intentional time out of the frontline to strategise, to reading, to keeping yourself healthy and vital, to attending webinars and online courses or becoming part of mastermind groups.

The key thing is taking action now to invest in yourself so that you know what to prepare for and how to act in this inflationary environment.

Here are 5 suggestions of investments you can make in yourself and with your time and resources to help you right now:

#1 Invest time to look up and read some economic reports that help you understand the mechanics of what’s happening rather than getting caught up in the fear of dramatised press articles.

#2 Invest in good property [this may well require a prior step to invest in your education first, to understand how to safely invest in property]. At a very simple level, what happens to property in an inflationary environment? Good letting stock appreciates, the monthly rent goes up with the imbalance of demand exceeding supply, and the magnitude of debt in real terms diminishes. So, it makes sense to increase your long term asset holding in times of inflation.

#3 Protect your margins – if you have a cashflow business like HMOs or SAs where you are responsible for variable costs you need to do as much as you can to control those monthly outgoings. Just this week I had a meeting with our Property Managers to run analysis on our monthly utilities and get communication out to our emergency accommodation guests about fair usage (this message will also go to contractor and holiday guests). You can also look at increasing your nightly rates slightly to accommodate the increased utilities costs.

#4 Move the responsibility of utilities from you to your tenants where possible. With HMOs that I have in Scotland and England I am in conversations with my agents right now to move them from all inclusive and individual room tenancies to leasing the whole house ie one lease to a group of students with the Edinburgh property, or one long term lease to a housing association or supported living operator with the English HMOs.

#5 Carry out a review of your portfolio to explore the merits of a product switch now. Even if a mortgage on a BTL is not due to expire until next year, the early repayment charge might be relatively small compared to the long term saving you make by locking in a lower interest rate on a 5 year fix now as opposed to a likely higher rate come the time of expiry next year. I am literally going through this process with a couple of properties now.

How will you invest in yourself right now?