For many, this week will probably go down as one of the most surreal we can remember. The impact of COVID-19 on financial markets, the rapid unfolding of news relating to travel restrictions, the emptying of supermarket shelves…the list goes on.

For my own family, we had the agonising decision making process of weighing up the risks and choosing to cancel our ski holiday – a decision that broke our snow-loving boy’s hearts. We were due to fly out to Geneva on Saturday morning, then take a transfer out to Morzine. With everything operating as normal in the resort on the Friday, we had to make a decision based on potential border and transport lock down risks. Wow, are we glad we made the call to stay at home – 24 hours after our decision, the official reports came out that our ski resort was closing. So if we had would flown out we’d have had to figure out trying to get straight back home again.

So, what’s the point in sharing this little drama? Firstly, I hope that you and your loved ones are in good health amongst all of this. My guess is that many of you are having to make some challenging decisions every day as more news unfolds. The main reason for this post is to share my two cents on perspective and attitude.

Have you ever read about the concept of extreme ownership? [There’s a book of that title written by former Navy Seals, and many business leaders/coaches talk about a similar message]. The concept is essentially about taking ownership and responsibility for everything in ‘your world’. Darren Hardy, who I’ve followed for years, teaches us that we are 100% responsible for what we do, didn’t do, and how we choose to react to things.

It’s on this same vein that I chose the headline quote of this post – “PLAY THE HAND YOU’RE DEALT LIKE IT’S THE HAND YOU WANT”- [a quote I heard from Inky Johnson, a former NFL hopeful who had his dreams crushed by a freak accident but emerged successful on a different path].

Whilst I know it is crazy to ever imagine wanting this situation we find ourselves in [well, my kids are hoping to be off school :)], the reason I chose the title and topic of this post was to remind us all that how we emerge from this situation will come down to our choice of perspective and attitude. It will come down to how we choose to see things, what we focus our minds on and the attitude we choose to take each day. Will you be focused on problems, or on solutions and even opportunities?

Here’s a quick look at just some of the areas where we will need to be proactive, solution oriented and possibly even opportunistic as people in property:

# With the bank base rate being cut to .25%, some of you will automatically benefit from monthly payment reductions if on variable rates. Even if you’re on fixed rates, how about asking for a reduction? Our mentor Paul Smith advocates all of us should at least be asking the question of lenders, you never know. Now that I have a week back at the desk and not on the slopes I’ll certainly be asking my lenders for reductions.

# If people start losing their jobs, what will that mean for their ability to pay the rent? I’ll be contacting all of the letting agents who manage my long term single lets this week to understand the employment status of my tenants so I can be as prepared as possible.

# How will Serviced Accommodation be affected? We have already started to feel the sting of a few tourist related cancellations. However, there is good reason to believe that SA operators could experience an upcoming spike as more people want self-contained property over hotels where there would be more public interaction. Thankfully our focus is not on the tourist market, but it does mean we’ll need to double down on finding the bookings from contractors and other more local sources. What about the opportunities that might come from the health service? I read in the paper today that The Department of Health is in talks about using hotel rooms as hospitals. This prompts the thinking, what non-tourist related audiences might you be able to help serve in your local area with your SA units?

# Preserving and managing your cash. Whilst the lockdowns may not hit your property business as hard as others, if anything it will bring a keener sense of financial control to any business owner. In other words, this might be the nudge you need to do a full cost review of all direct debits and standing orders – you might be paying more for utilities and wifi than you need to for example, or may even be paying for services and subscriptions that the business isn’t even using.

# For the commercial property investors out there – restaurants and retailers are likely to be hit pretty hard and casual dining chains are already begging landlords for rent holidays. If, like us, you are actively investing in commercial property, think long and hard about the commercial tenants you are looking to serve, you want a sustainable investment.

# Commercial property owners in Scotland will be pleased to hear that the Finance Secretary has announced a 75% rates relief for shops and venues with a rateable value of less than £69,000 and grants of at least £3000 will be made available to small businesses in sectors facing the worst economic effects of coronavirus.

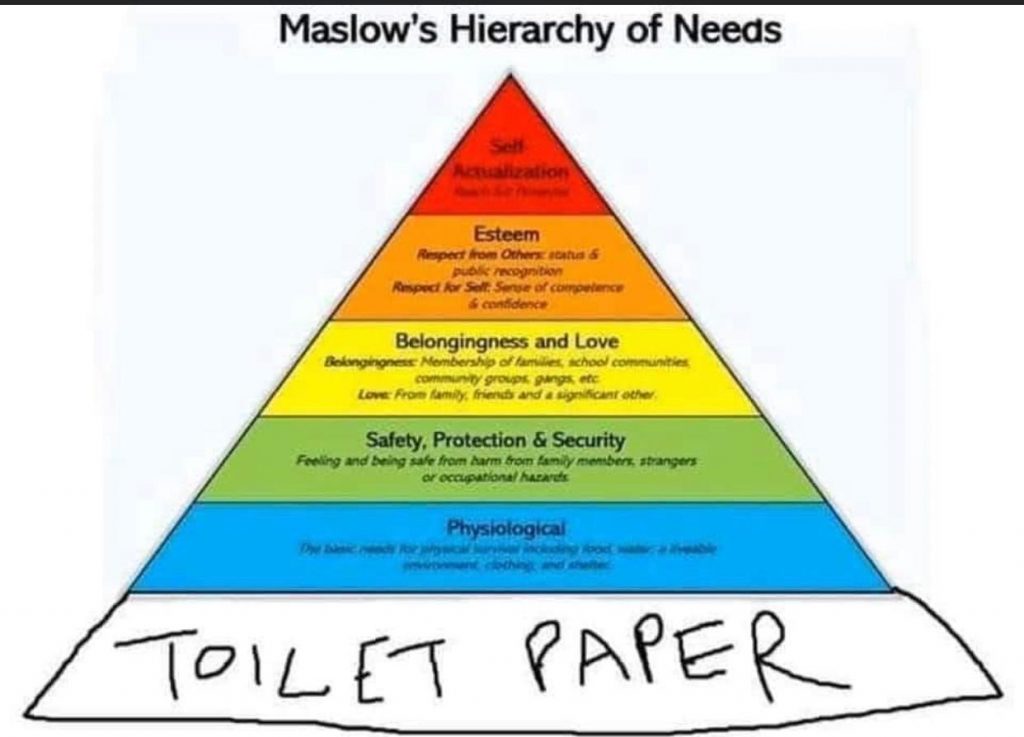

So that was a handful of things I picked up from recent conversations and reading that thought might be relevant for you to think about going into the coming weeks. One thing I find fascinating is how, as nations, the mind is being focused on basic fundamentals like food water and shelter, hence the run on supermarkets…. and this humorous revision to Maslow’s hierarchy of needs. I am so grateful to be in the comfort of our home, safe with everything we need, as opposed to being stuck in a ski resort on lockdown.

I’m curious to hear what thoughts are going through your heads at the moment – what uncertainties or questions might you have in relation to your property businesses in the weeks ahead? And how can you ‘play the hand you’re dealt like its the hand you want’?