When I was out jogging this week I listened to a great podcast episode by Peter Voogd on the subject in the title. I think it’s a great guide for how we can all allocate our money, which is why I wanted to share my notes from the podcast here with the community.

So, here’s a summary of what successful people spend their money on:

#1 They invest in themselves

This could be anything from books, seminars, training, mentorships, anything to sharpen perspective and cut their learning curve in half. Things that can save you time, money, energy, perhaps save you from failure or making the same mistakes that someone else had.

In business speed is super important and you want to pay for speed. A smart person learns from their mistakes, as all successful people do, but those wanting world class results learn from other people’s mistakes so they can shorten their learning curve and not waste as much time making the same mistakes. When you get some skin in the game it forces you to level up and take action.

Jim Rohn wisely advocated “to work harder on yourself than you do on your job. If you work hard on your job, you’ll make a living, if you work hard on yourself, you’ll make a fortune.”

That’s why investing in yourself is top of the list. When invest in yourself on training and mentorships, it’s the fastest way to become more efficient…more intelligent, so you know not just where to invest but how to make more money.

When Chris and I made the decision to invest in mentorship in 2016, in 2017 we had a breakout year. It wasn’t a coincidence. As Peter Voogd points out, “If you think personal growth is expensive, try mediocrity and regret.”

All the prominent people in the personal development space will advocate that you should always be investing in yourself. Authorities like Tony Robbins, Brian Tracy, Darren Hardy…and many more typically suggest we should be investing at least between 5-15% of our income back into ourselves.

#2 They invest back into their business

In other words re-directing a proportion of profits back into the business. For any business looking to grow, some investment back into it is necessary. This could be anything from marketing to staff, to systems or a new strategy. Voogd recommends the amount you choose to be re-invested is related to a specific strategy and a plan rather than just a set number of a percentage, but don’t reinvest to the point of cutting other parts of your company short. It’s also crucial to invest in a team that aligns with your vision and values – he advocates that business owners should be producing growth not maintaining things, anything that maintains the business should be systemised and delegated. You’ve heard it before but the biggest thing is to be able to work ON your business, not just IN it. Ultimately reinvesting can help you establish your business as a leading provider in your space whilst also putting you on track for continuous gradual improvement.

Warren Buffet says ‘reinvesting your profits is the best and only way to build real wealth’.

#3 They invest in assets that make their money work for them

To secure their future they make sure they are continuously investing in assets that grow and compound their money. Financially successful people don’t really care so much about impressing other people with their money, they live below their means so they can invest their money and increase their wealth. If you only trade time for money, you’ll work until you die. The key is leveraging your (and other’s) money. This point is preaching to the converted in the property community.

#4 They invest in memorable and inspiring experiences

I love this one. Interestingly, Voogd cites a CNBC study that highlights how those in the ‘7 figure club’ are pretty practical when it comes to spending their money. CNBC surveyed over 500 millionaires, and it found that the biggest annual spend was on home improvements and holidays/experiences. He reminds us that we can’t put a price tag on good experiences and memories. The beauty of this fourth category is that it can create a virtuous cycle – ie when we spend money on experiences for loved ones it not only creates wonderful memories but it inspires us at a different level to continue to produce results and create a life we are proud of for our family. However, getting the order of these investments is also key, ie not to go too big on #4 until no.s 1-3 are taken care of.

Hopefully this serves as a powerful reminder of how to allocate your money when you start making a bit.

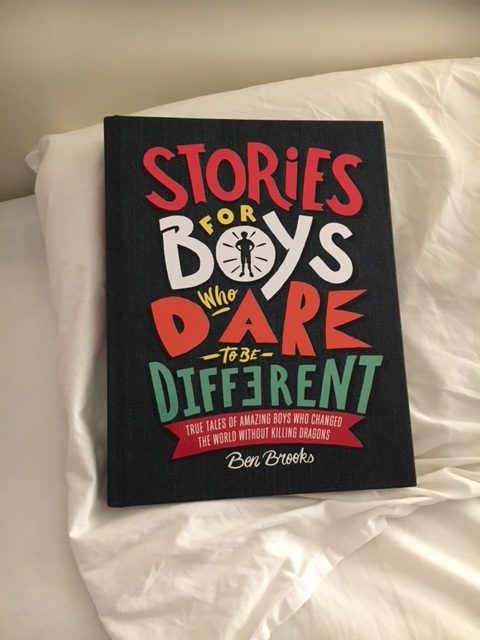

Closing notes: This weekend we spent 2 nights away as a family sampling another providers serviced accommodation. Having written this post it’s reaffirming to see that we were investing in category #4 by creating fun experiences and memories as a family – we explored Crail where we took in the food festival and sampled delightful freshly cooked crab and steak from vendors on the harbour wall. We taught the kids how to catch crabs with a line over the wall in the seaweed, and we saw Scotland’s largest defence bunker (built to survive a nuclear bomb). Today we wondered round St. Andrews and whilst in a bookshop my eldest son spotted the book pictured above, now on his pillow. Investment category #1 both for me and my son 🙂

I’d love to hear any other thoughts on key things that successful people spend their money on.