This post highlights the importance of aligning your weekly priorities with your property and business strategy depending on where you are on your investor/business owner journey, and where you want to go.

We are already at the end of January and while everyone will have big dreams for 2022 and beyond, it’s wise to be clear on how our weekly priorities are aligning with the bigger picture.

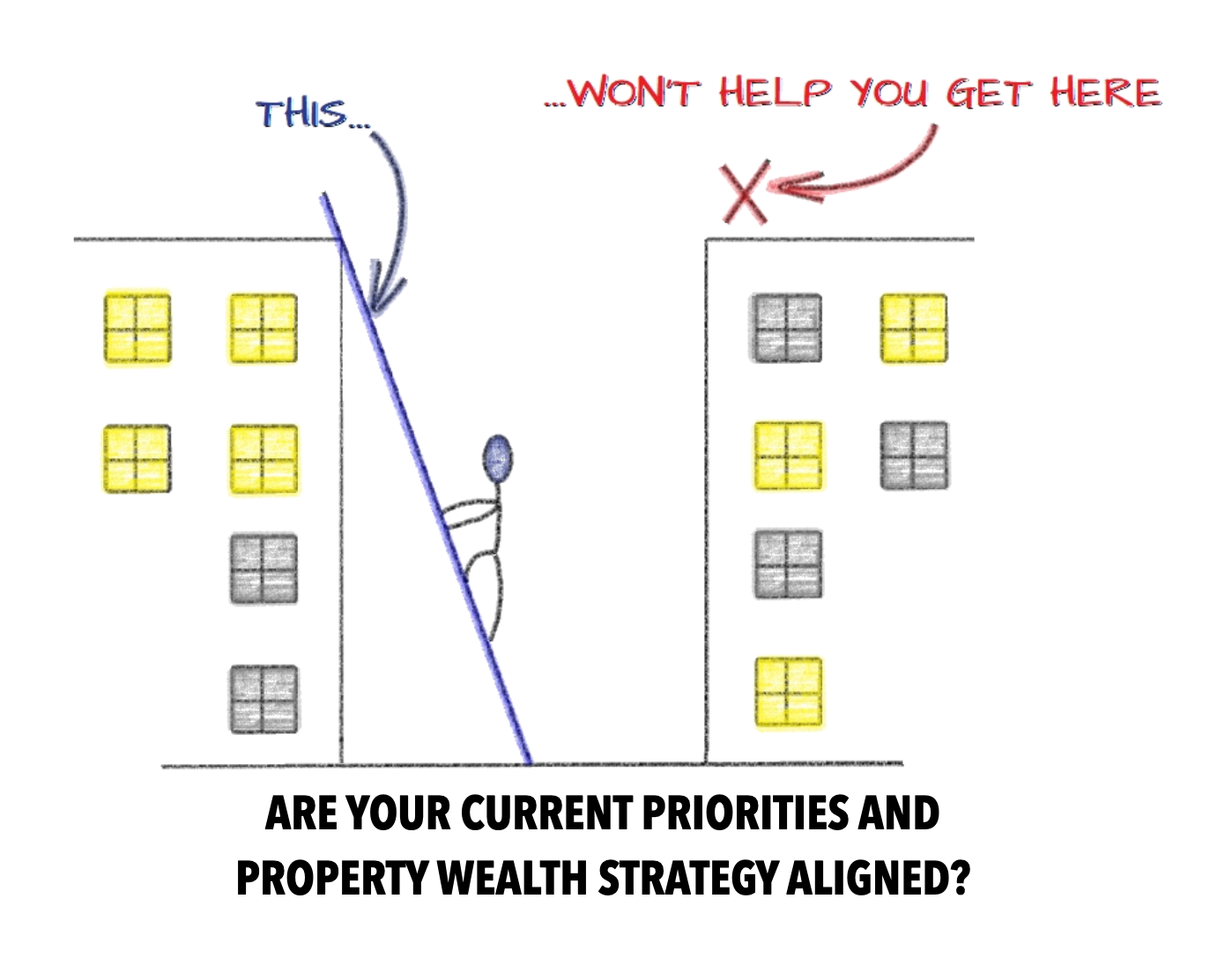

To help emphasise the point I’m making and paint a visual picture, I’ll borrow these wise words from Stephen Covey –

“If the ladder is not leaning against the right wall, every step we take just gets us to the wrong place faster.”

Had I not invested the deep thinking time to thoroughly consider and discuss with Chris what we want and why, that could have been us starting the year with the ladder not leaning against the right wall.

Here’s a bit of context:

Towards the end of last year part of me was thinking that we needed to scale our SA business and hire the right team that will help us do this. In other words an investment now in a bigger team for a future payoff of bigger revenue and bigger profits. But why would we want to scale our SA business to be even bigger when it’s already successful and profitable and generating consistent good cash flow?

Would we just be adding more ‘noise’ to our lives by having more properties and more associated operations for a little extra profit? Is that what we really want?

Quite fortuitously, I listened to a podcast on business strategy one morning in the gym at the start of January. Hearing that solidified my thinking on strategy for the year ahead and I instantly felt lighter about the decision NOT to scale big. I had clarity of thought on how we would prioritise our activities to align with the bigger wealth creation strategy.

The gist of the message that helped confirm my thinking was acknowledging that once a cash flow business is serving it’s purpose i.e. covering overheads and paying for living expenses then there’s no point wasting any more time on it. That may sound counter intuitive but it’s incredibly liberating.

Anyone who has a trading business knows that whilst they are great for providing monthly income, they come with an amount of proverbial ‘noise’. In other words things like managing customers and suppliers, staff, operations etc etc.

We set up a great wee SA business in 2017 and have gradually grown it, predominantly with R2R and a handful of owned properties. It has taught us a huge amount about combining property investing with entrepreneurship and business.

Trading businesses in property might be R2R for SA or HMO, property management or sourcing for example…typically something where we exchange a degree of time for a decent sized cash flow that replaces any need to have a job. This is the logical first step for anyone looking for property to replace employed income in a relatively short period, and without a significant capital pot to invest in multiple BTLs.

One can carry on running a trading business for years, and for many that may be the desired end game. However if the bigger vision is serious long term wealth, and time freedom then at some point there needs to be a conscious focus on creating large profit events that provide the funds to invest in multiple assets that provide growing equity and passive income.

MJ DeMarco describes a similar process in his book Millionaire Fastlane where he talks about first creating a ‘Business System’ (ie your primary income source from your main entrepreneurial endeavour) that pays your income and feeds into a ‘Money System’ (ie a way to earn interest off your capital) which eventually takes over the need to run a business. I’ve summarised DeMarco’s WEALTH CALCULATION in a past blog post here and I recommend you check it out to figure out your own property wealth calculation, its a fun and essential exercise.

Figure out your property wealth calculation here:

Back to my point -whilst Chris and I have been slowly building up the asset base alongside running the trading business, the clarity came that this is where our focus needs to be – prioritising time on longer term projects that have the options of delivering big profit when sold and serious equity and long term passive income when held.

With clarity and focus we can move forwards with conviction and confidence, without second guessing or FOMO. Most importantly we can set priorities that align with our wealth strategy.

So, instead of trying to double our SA business, which would have been incongruent with our bigger picture, we can instead focus on the longer term projects. We have an exciting land development project kicking off now and once that’s ticking along we will be able to allocate some focus on pipelining the next multi-unit development.

What are you currently prioritising?